Managing your Employees’ Provident Fund (EPF) account efficiently is crucial for ensuring hassle-free transactions, withdrawals, and benefits. However, if your Know Your Customer (KYC) status is pending, it could lead to delays in claim processing and fund access. The good news? You can update and approve your EPF KYC details online from home in just a few clicks

This guide will walk you through the step-by-step process of getting your KYC approved instantly, ensuring smooth operations of your EPF account without unnecessary delays.

PF KYC Pending

| Aspect | Details |

|---|---|

| Purpose of KYC | Required for seamless EPF transactions, withdrawals, and benefits. |

| Documents Needed | Aadhaar, PAN, Bank Account, Passport, Driving License, etc. |

| Approval Time | Typically 3-5 working days (may vary). |

| Official Portal | EPFO Member e-Sewa Portal |

| Employer’s Role | Verification & approval of KYC details. |

| Common Issues | Mismatched details, delayed employer approval, outdated documents. |

| How to Check Status | Log in to EPFO portal > KYC Section > Approval Status. |

Updating your EPF KYC details is a simple but essential step for seamless management of your provident fund account. With this step-by-step guide, you can easily submit, verify, and track your KYC approval from the comfort of your home. By ensuring your Aadhaar, PAN, and bank details are up to date, you can avoid unnecessary delays and enjoy hassle-free EPF withdrawals and benefits.

Pro Tip: Regularly check your UAN & EPF account for any updates or discrepancies.

Also check: PM Awas Yojana Survey: Last Date Announced! Check Eligibility & Ineligible Families

PF KYC Pending: Why Is KYC Important for Your PF Account?

KYC is a mandatory process that helps the Employees’ Provident Fund Organisation (EPFO) verify the identity of employees and prevent fraudulent transactions. Without KYC approval, you might face:

- Delays in withdrawing EPF funds.

- Issues with linking Aadhaar and UAN.

- Problems in receiving EPF benefits, pension, and insurance claims.

To ensure seamless access to your provident fund, it’s essential to update and approve your KYC details on the EPFO Member Portal.

PF KYC Pending: Step-by-Step Guide to Update & Approve PF KYC Online

Follow these simple steps to update your EPF KYC details from home and get them approved instantly.

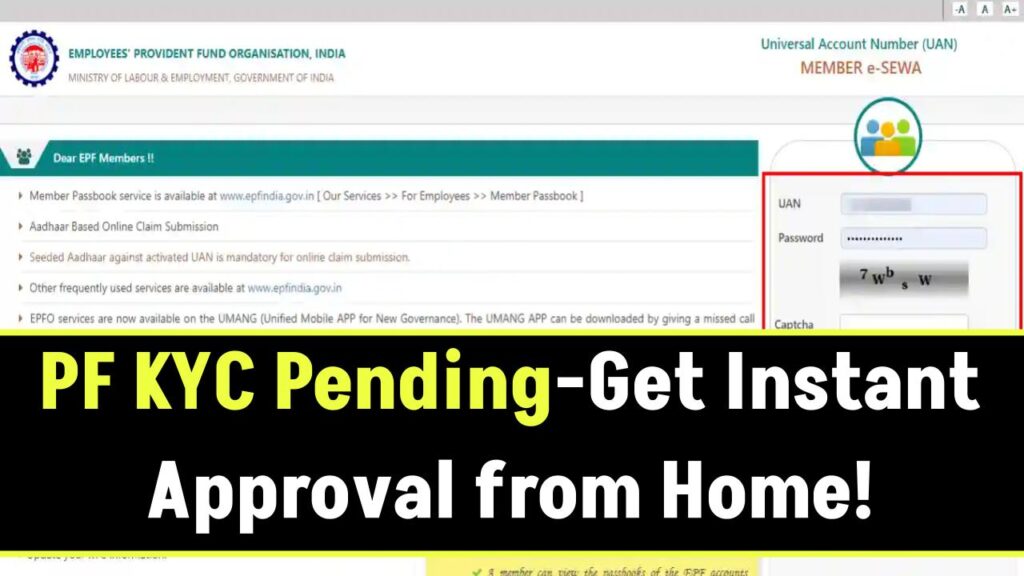

Log in to the EPFO Member Portal

- Visit the EPFO Member e-Sewa portal.

- Enter your Universal Account Number (UAN), password, and the captcha code.

- Click ‘Sign In’ to access your account.

Tip: If you forget your password, use the ‘Forgot Password’ option to reset it using your registered mobile number.

Navigate to the KYC Section

- Click on the ‘Manage’ tab.

- From the dropdown menu, select ‘KYC’.

Upload & Submit Your KYC Documents

- You’ll see options to update different documents such as:

- Aadhaar Card (for identity verification)

- PAN Card (for tax-related benefits)

- Bank Account Details (for direct credit of EPF funds)

- Passport, Driving License, or Voter ID (optional for additional verification)

- Tick the checkbox next to the document you want to update.

- Enter the required details exactly as per the document.

- Click ‘Save’ to submit your details.

Important: Ensure the details match exactly with your records to avoid rejection.

Wait for Employer Approval

Once submitted, your KYC details move to the ‘Pending for Approval’ section. Your employer needs to verify and approve them.

Employer Approval Process:

- The employer logs in to the EPFO Employer Portal.

- They review and approve your KYC details.

- Once approved, EPFO verifies the information.

Processing Time: Typically 3-5 working days (may vary).

Check KYC Approval Status

- Log in to the EPFO Member Portal.

- Click on ‘KYC’ under the ‘Manage’ tab.

- If approved, your details will be listed under ‘Digitally Approved KYC’.

- You’ll also receive an SMS notification confirming approval.

Also Check: Google’s Big Update: Now Remove Personal Info, Photos & Videos Easily—Here’s How!

PF KYC Pending: Troubleshooting Common Issues

If your KYC is still pending, check these possible reasons:

| Issue | Solution |

|---|---|

| Mismatched details | Ensure your name, DOB, and ID numbers match official records. |

| Delayed employer approval | Contact your HR department for a follow-up. |

| Technical errors on portal | Try updating KYC using a different browser or device. |

| Outdated documents | Ensure uploaded documents are valid and clear. |

Still facing issues? Contact the EPFO Helpdesk at https://www.epfindia.gov.in/.

Also Check: 7 Must-Watch Smartphone Launches in March 2025 – Specs, Prices & Dates!

PF KYC Pending (FAQs)

How long does it take for EPFO KYC approval?

It usually takes 3-5 working days, but delays can occur due to employer inaction or document mismatches.

Can I update my KYC without employer approval?

No, employer approval is required before EPFO verifies and approves your KYC.

Is Aadhaar mandatory for EPF KYC?

Yes, Aadhaar is a primary requirement for seamless linking and withdrawal of EPF funds.

How do I check if my KYC is approved?

Log in to the EPFO Member Portal, go to the KYC section, and check the approval status.

What happens if my employer does not approve my KYC?

You should contact your HR department or file a complaint via the EPFO grievance portal.