India’s GST Hits ₹1.84 Lakh Crore Goods and Services Tax (GST) collections have surged to a record-breaking ₹1.84 lakh crore in February 2025, marking a 9.1% increase compared to the same month last year. This impressive growth reflects a strong economy, increasing consumption, and effective tax compliance. But what does this mean for businesses, consumers, and the overall Indian economy?

Let’s break it down in a simple, easy-to-understand way so that both professionals and general readers can grasp the implications.

India’s GST Hits ₹1.84 Lakh Crore

| Key Metric | Value (Feb 2025) | Year-on-Year Growth |

|---|---|---|

| Total GST Collection | ₹1.84 lakh crore | 9.1% |

| Central GST (CGST) | ₹35,204 crore | – |

| State GST (SGST) | ₹43,704 crore | – |

| Integrated GST (IGST) | ₹90,870 crore | – |

| Compensation Cess | ₹13,868 crore | – |

| Domestic GST Revenue | ₹1.42 lakh crore | 10.2% |

| GST from Imports | ₹41,702 crore | 5.4% |

Source: Ministry of Finance

India’s ₹1.84 lakh crore GST collection in February 2025 is a strong indicator of a growing and stable economy. With higher consumer spending, efficient tax compliance, and improved government policies, India’s GST framework is evolving positively. For consumers, this means stable prices and better public services. For businesses, it ensures growth and easier tax compliance. Looking ahead, the government’s focus on tax reforms and digital compliance will make GST even simpler and more efficient.

Stay updated with GST changes and ensure you’re taking advantage of available tax benefits!

Also Check: Ramzan 2025 Moon Sighting Update! Check When Ramadan Starts in India

India’s GST Hits ₹1.84 Lakh Crore: What’s Driving the Growth in GST Collection?

Several factors have contributed to this increase in tax revenue, including:

Strong Economic Recovery

- India’s GDP growth has remained strong, with increased industrial production and retail sales.

- More people are spending money, leading to higher tax collection from goods and services.

Improved GST Compliance

- The government’s stringent tax compliance measures have reduced tax evasion.

- E-invoicing and AI-driven tax monitoring have helped improve transparency.

Higher Imports & Domestic Consumption

- Imports have grown by 5.4%, contributing significantly to IGST collections.

- Domestic demand for essential and luxury goods remains strong.

Increase in Digital Transactions

- Digital payments have become the norm, reducing cash transactions and increasing tax accountability.

India’s GST Hits ₹1.84 Lakh Crore: How Does This Impact You?

For Consumers

- Stable Tax Rates – No immediate changes in GST rates mean prices remain stable for most goods and services.

- Improved Public Services – More tax revenue allows the government to invest in healthcare, infrastructure, and education.

- Inflation Monitoring – While higher tax collection is good, consumers should watch for inflation as increased spending can push prices up.

For Businesses

- More Input Tax Credit (ITC) – Companies can claim more tax credits, helping them save money.

- Easier Compliance – Digital GST systems have made tax filing easier and faster.

- Higher Demand – Increased consumer spending boosts business revenues and profits.

For the Government

- Higher Revenue for Development – More funds available for public welfare projects.

- Lower Fiscal Deficit – Improved tax collection reduces India’s budget deficit, leading to economic stability.

Also Check: Golden Opportunity! 5,500 Job Openings in Japan, Germany & Israel – Apply Now

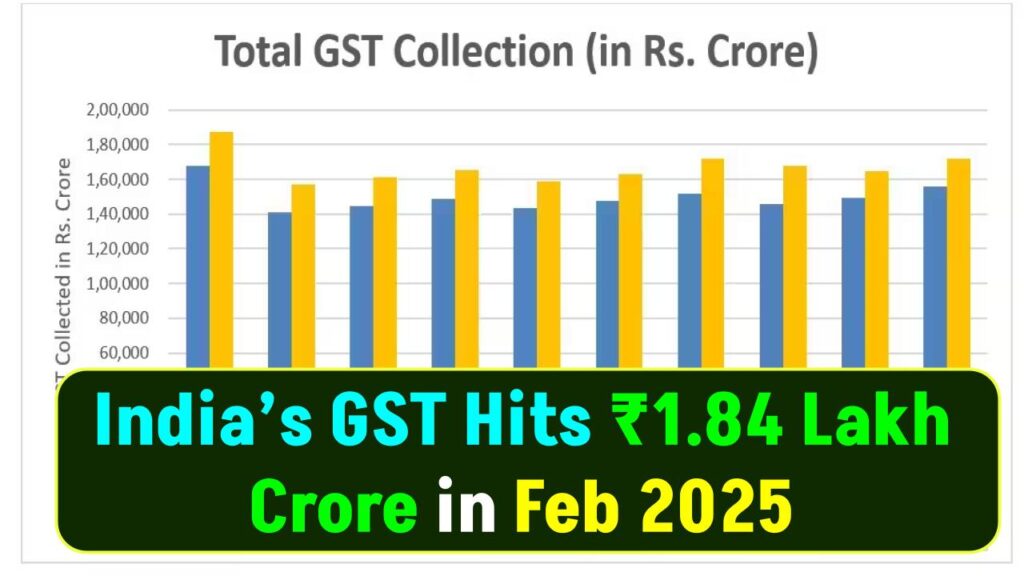

India’s GST Hits ₹1.84 Lakh Crore: A Closer Look at India’s GST Collection Trends

GST collections have consistently grown over the past few months. Let’s compare recent collections:

| Month | GST Collection (₹ in lakh crore) |

|---|---|

| Feb 2025 | ₹1.84 lakh crore |

| Jan 2025 | ₹1.88 lakh crore |

| Dec 2024 | ₹1.79 lakh crore |

| Nov 2024 | ₹1.78 lakh crore |

As seen, GST collections remain strong, indicating robust economic activity.

India’s GST Hits ₹1.84 Lakh Crore: What’s Next? Future of GST in India

The Indian government is working on simplifying GST further to boost compliance and reduce tax burden. Some expected reforms include:

- GST Rate Rationalization – Reducing multiple tax slabs (5%, 12%, 18%, 28%) to fewer, simplified rates.

- Lower GST on Essential Goods – Possible reduction in food, healthcare, and transport taxes.

- Stronger AI-Based Compliance – Use of AI and data analytics to prevent tax fraud.

Also Check: Breaking: Shimla Imposes Green Tax! Check New Charges for Outside Vehicles

India’s GST Hits ₹1.84 Lakh Crore (FAQs)

Why did GST collections increase in February 2025?

The increase is due to higher consumer spending, better tax compliance, and strong import growth.

Will this impact GST rates in the future?

For now, no immediate changes in tax rates are expected. However, tax rate rationalization may be introduced later.

How does higher GST collection benefit the economy?

Higher collections mean more government revenue, leading to better public services, infrastructure, and economic stability.

Will businesses get more tax benefits?

Yes! Businesses can claim more Input Tax Credit (ITC), which helps reduce their overall tax burden.